Question

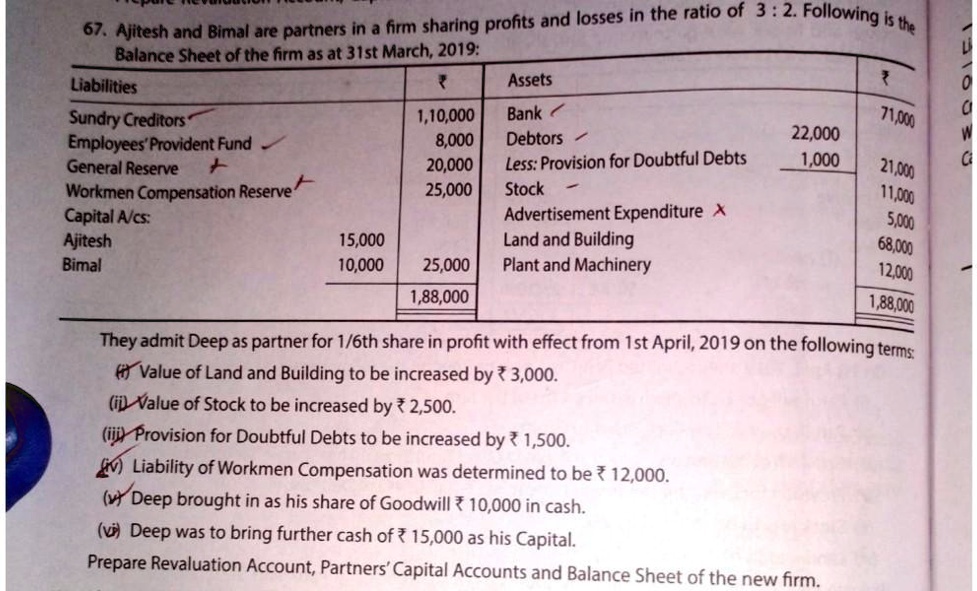

How to solve this? Profits and losses are in the ratio of 3:2. Following 67 Ajitesh and Bimal are partners in a firm, sharing the Balance Sheet of the firm as at 31st March 2019: Liabilities Assets Sundry Creditors ~ 1,10,000 Bank 71 Employees' Provident Fund 8,000 Debtors 22,000 General Reserve 20,000 Less: Provision for Doubtful Debts 1,000 Workmen Compensation Reserve - 25,000 Stock In Capital Alcs: Advertisement Expenditure 50 Ajitesh 15,000 Land and Building 6,800 Bimal 10,000 25,000 Plant and Machinery 12,000 1,88,000 1,88,010 They admit Deep as a partner for 1/6th share in profit with effect from 1st April 2019 on the following terms: (i) Value of Land and Building to be increased by < 3,000. (ii) Value of Stock to be increased by < 2,500. (iii) Provision for Doubtful Debts to be increased by < 1,500. (iv) Liability of Workmen Compensation was determined to be 12,000. (v) Deep brought in as his share of Goodwill 10,000 in cash. (vi) Deep was to bring further cash of 15,000 as his Capital. Prepare Revaluation Account, Partners' Capital Accounts, and Balance Sheet of the new firm.

How to solve this?

Profits and losses are in the ratio of 3:2. Following 67 Ajitesh and Bimal are partners in a firm, sharing the Balance Sheet of the firm as at 31st March 2019:

Liabilities Assets

Sundry Creditors ~ 1,10,000 Bank 71

Employees' Provident Fund 8,000 Debtors 22,000

General Reserve 20,000 Less: Provision for Doubtful Debts 1,000

Workmen Compensation Reserve - 25,000 Stock

In Capital Alcs: Advertisement Expenditure 50 Ajitesh 15,000

Land and Building 6,800 Bimal 10,000

25,000 Plant and Machinery 12,000

1,88,000 1,88,010

They admit Deep as a partner for 1/6th share in profit with effect from 1st April 2019 on the following terms:

(i) Value of Land and Building to be increased by < 3,000.

(ii) Value of Stock to be increased by < 2,500.

(iii) Provision for Doubtful Debts to be increased by < 1,500.

(iv) Liability of Workmen Compensation was determined to be 12,000.

(v) Deep brought in as his share of Goodwill 10,000 in cash.

(vi) Deep was to bring further cash of 15,000 as his Capital.

Prepare Revaluation Account, Partners' Capital Accounts, and Balance Sheet of the new firm.

Show more…

Added by Megan F.

Instant Answer

Step 1

- Land and Building: 6,800 + 3,000 = 9,800 - Stock: 21,000 + 2,500 = 23,500 - Provision for Doubtful Debts: 1,000 + 1,500 = 2,500 - Workmen Compensation Reserve: 12,000 (as determined) Show more…

Show all steps

Suzanne W. and 65 other

Principles of Accounting educators are ready to help you.

Ask a new question